BLOG POST WRITTEN BY GIAMBRONE & PARTNERS LLP

The British government is taking robust measures to combat financial fraud and economic abuse. In February 2022 the Government published a White Paper, Corporate Transparency and Register Reform on a range of measures driven by a determined effort to close down a range of global economic and financial fraud, such as fraudulent ‘shell’ companies, money laundering and phoenix trading, perpetrated by criminals registering commercial entities at Companies House to create the appearance of legitimacy.

Companies House will, in future, play a major role in preventing the abuse and the reforms to the role of Companies House will be fundamental to the control of white-collar financial crime. These changes will be implemented by the Economic Crime (Transparency and Enforcement) Bill and together with the clause relating to Register of Overseas Entities will act in tandem to provide accountability and enable the close monitoring of commercial entities to ensure that there are no breaches to the globally accepted economic and financial laws.

This was initially prompted by Financial Action Task Force (FATF), also known as Groupe d’action financière formed in 1989 initially to develop international policies to oppose money laundering and latterly terrorism financing, that identified the UK in its ongoing reporting on anti-money laundering and counterterrorist financing measures, as a country that had an existing framework suitable for monitoring and preventing corporate entities misuse in respect of money laundering and terrorist finance.

The most radical and important change is the introduction of identity verification and the capacity of Companies House to demand the verification of all company directors, persons with significant control, members of LLPs and any persons submitting filings or incorporating an entity at Companies House.

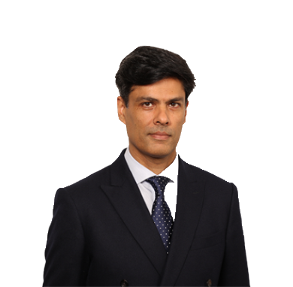

Khizar Arif, a partner based in the Birmingham office, commented “the new responsibilities and powers granted to Companies House will completely alter the entire nature of the organisation from simply recording and making information available to one that has a regulatory role to ensure the entities entered on the register are legal, accurate and most importantly compliant with all laws governing their financial dealings across the globe” Khizar further mentioned “the government is determined to make every effort to stamp out the pernicious rise of economic and financial fraud thereby limiting the financial impact of fraud, and delivering advantages and benefits to the whole business community”

How will the new measures be implemented?

The verification will take the form of photo identity; to be compliant any photograph must match any other identifying document. Users will be able to access all Companies House services once they have been verified. Should a director fail to register and be verified at the end of the requisite period they will be committing an offence for which there will be a penalty, additionally, a company directed by an unverified director will also be committing an offence and may be penalised.

A new Power of pre-registration

Companies House will have the power to reject and also query information connected to new filings and will also be able to question information already appearing on the register. Pre-registration provides a new power enabling Companies House to reject documents with valid reasons which will enable an entity to re-submit once a query has been dealt with. Following registration, if a query arises the entity will have 14 days to respond. Failure to respond or an inadequate response provokes the potential for sanctions to be imposed.

Within the discretionary powers bestowed on Companies House to remove material that is considered to have a bearing on the integrity of the register, it has been recognised that in some instances removal may be a matter for the court.

Register of Overseas Entities

A Bill relating to the registration of overseas entities was proposed five years ago. This obligation now appears in the Economic Crime (Transparency and Enforcement) Bill. The Government is hastening the progress of this new legislation. The register must hold the information defined in the Economic Crime (Transparency and Enforcement) Bill. Included in the information required is the name of each overseas entity and a statement to the effect that the entity has complied with section 12 and also anything required by the regulations under section 16 related to the registrable beneficial owners and managing officers. The information must be current and verifiable

Overseas entities will be bound by the Bill in relation to holding the freehold of land in the UK and must be beneficial owners registered at Companies House, there are also time restrictions relating to the sale, leasing or mortgaging the land if the registration of beneficial ownership has not been completed. The information must also be accurately updated annually.

Corporate Directors and Shareholders

With regard to corporate directors, going forward, UK businesses can only appear as corporate directors of another UK business providing that they are verified to provide complete clarity around the question of ownership. Also in the name of transparency, the full names of all shareholders must be recorded. Additionally, the Registrar of Companies is permitted to pass on all relevant information to law enforcement agencies and other types of regulatory bodies, in certain circumstances, which are foreseen as being related to financial and economic crime.

Giambrone & Partners’ highly experienced corporate and commercial teams are able to assist both British companies and overseas businesses fulfil their new obligations in relation to the Economic Crime (Transparency and Enforcement) Bill. Our multi-jurisdictional lawyers have years of experience with compliance and regulatory issues across Europe. Our lawyers are multi-lingual and will be able to explain the principles of the new regulations and the obligations arising in your own language.

Khizar Arif is a leading lawyer in Giambrone & Partners’ litigation and dispute resolution team. Initially, he was called to the Bar of England in 2001, Khizar was then admitted to the Roll of Solicitors, attaining Higher Rights of Audience shortly thereafter. He holds a Master of Laws degree (LL.M.) focused on international business and maritime law from the University of Hamburg, Germany.

Khizar regularly appears in the County Courts and the High Court, advises on all aspects of dispute resolution and litigation, from pre-action stage to settlement or trial through to enforcement. He helps clients in informal negotiations and, if appropriate, on alternative dispute resolution methods such as mediation and arbitration.

To learn more about how Khizar Arif and Giambrone & Partners can help you, or for additional information about how to go about appeals please email his clerk Sam Groom SG@giambronelaw.com or please click here